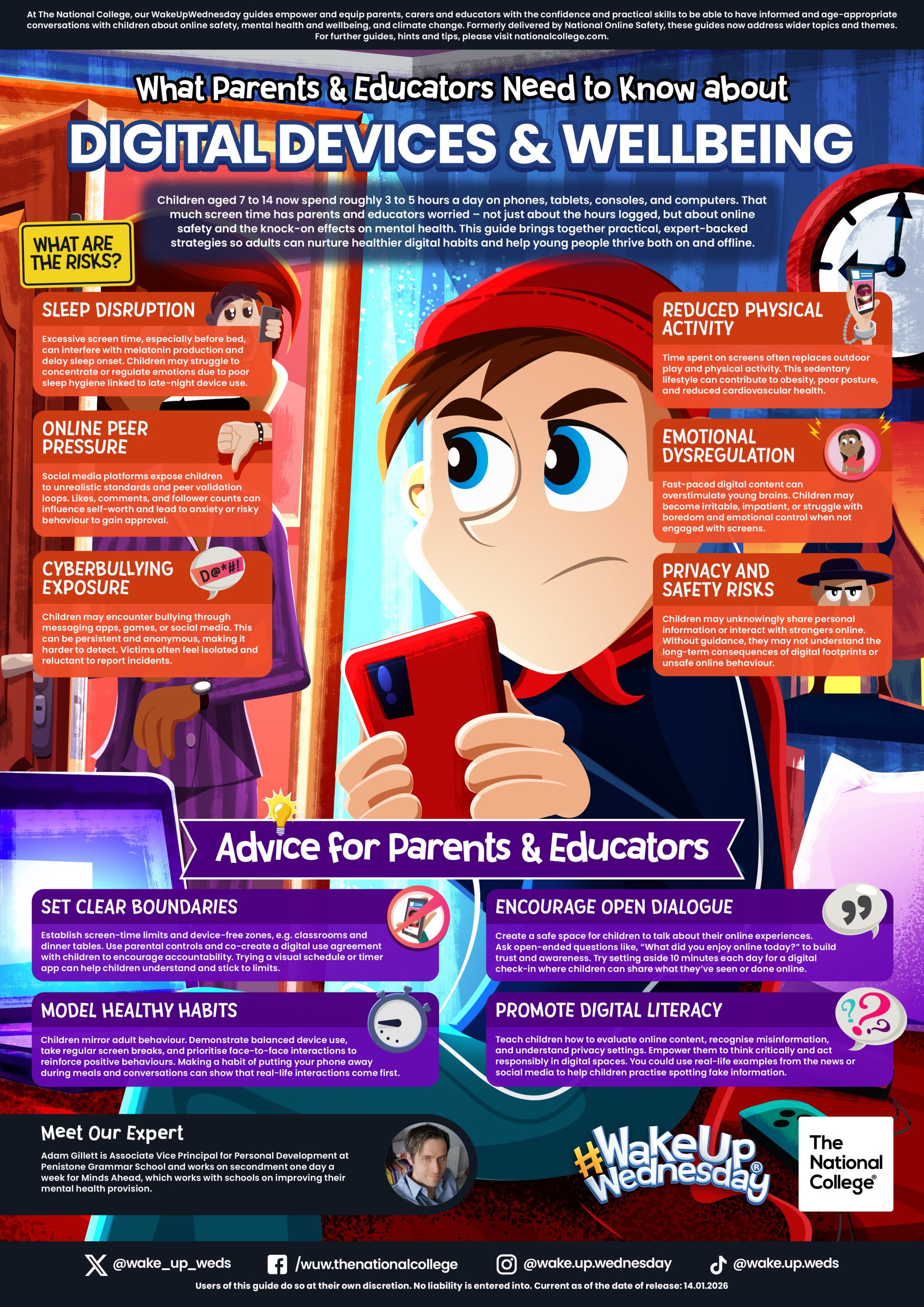

Digital devices are woven into everyday life for children and young people, but balancing the benefits with potential risks can feel challenging. This #WakeUpWednesday guide explores how screen use can influence sleep, emotional regulation, physical health and online experiences, offering clear context around why concerns about wellbeing are growing.

Written with schools and families in mind, the guide shares practical, realistic advice for setting boundaries, encouraging open conversations and building digital literacy. With insights from an experienced mental health professional, it supports adults to help children develop healthier, more mindful relationships with technology

On Wednesday 17th December, Duke’s Secondary School held our first ever Proud Reward Ceremony.

PROUD

We were delighted to have hosted our first ever end-of-term Proud Celebration Ceremony, which is a new special way we as a school have been recognising the achievements, character and values of our wonderful students. Thank you to the staff who worked hard to organise the event and thank you to the families who joined us to celebrate their children.

Throughout the term, our Proud sessions have taken place every Friday lunchtime, alternating fortnightly between Years 7 & 8, and Years 9 & 10. These sessions provide students with the opportunity to share work they are most proud of, reflect on their progress and celebrate success in a supportive and encouraging environment. Students are also rewarded with ‘LIGHT Points’ – part of our existing school rewards system, recognising positive behaviour and effort, which contributes towards receiving prizes.

To mark the end of the term and the year, we brought these celebrations together in a whole-school ceremony, where students from each year group were nominated for special awards in recognition of their achievements and the way they live out our school’s LIGHT values: Love, Inclusivity, Goodness, Hope and Truth.

Thank you to our amazing staff for putting together such a lovely event and a big thanks to Mrs Chima who has taken the lead on the new Proud initiative. Mr Atkinson reflected on the evening “We are very proud of all of our students at Duke’s. However, it is lovely to be able to reward those students that have consistently displayed the characteristics that will lead to successful outcomes for them during their time in school”.

Mr Blight said “Thank you to everyone involved with the ‘Proud’ event. It was brilliant to see students, parents/carers and staff coming together in partnership to celebrate achievement”.

Mrs Barker described the event as “A delightful way to end the term, seeing so many of our students being congratulated in such a lovely way. They continue to make us all proud and, are an absolute joy to teach”.

Awards presented included the Head of Year Award, the LIGHT Award and the Principal’s Award. Each recipient was chosen not only for their achievements, but also for the positive contribution they make to our school community.

Many students were recognised for being consistently polite, helpful, courteous and for being true assets to our school through the way they treat others. These everyday acts of kindness and integrity are what help make our school such a welcoming and inclusive place to learn.

We celebrated students for their exceptional work, drive and ambition. Our Year 13 students Sofiat has been recognised for her extreme devotion to success, taking 5 A Levels and embracing every learning opportunity that is available for her.

Our Year 8 student Feisal has been recognised for how well he’s fit in and positively contributed to the school community. Popular with his peers and teachers, he’s a real positive presence in school. He’s also been recognised for his incredible football talent, capturing the attention of Newcastle United and his teachers alike.

One of our Year 7 students Oliver has taken it upon himself to raise money and donations for the local charity Wansbeck Valley Foodbank, creating a musical virtual advent calendar where he plays the cornet, connected to the GoFundMe page which has exceeded it’s target! He also spent his own pocket money on a huge food hamper for a family in need. We’re incredibly proud of his compassion, empathy and drive to help others. If you would like to help Oliver raise more money for local families, click this link.

Many other students were recognised for being consistently polite, helpful and courteous, and for being true assets to our school through the way they treat others. These everyday acts of kindness and integrity are what help make our school such a welcoming and inclusive place to learn.

We would like to extend our sincere thanks to all the families who joined us for the ceremony. It was wonderful to see you all and to celebrate these achievements together. Your continued support plays a vital role in our students’ success, and we are grateful for the strong partnership between home and school.

Congratulations to all of our award recipients and those who were nominated. Thank you to every student who continues to show pride in their work, their character and their community. We look forward to many more moments of celebration in the future.

The December edition of the Duke’s Careers Newsletter is now available! This month, we focus on Connecting Learning to Careers, helping parents explore how their child’s studies link to future opportunities and career paths.

Packed with tips, advice, and resources, this newsletter is a great way for parents to engage with career planning and make the most of learning both inside and outside the classroom.

Read the newsletter here: Dec 25 Duke’s Careers Newsletter (1)

We wish all our students, families, and staff a very Merry Christmas and a Happy New Year!

are becoming increasingly common, offering children personalised interactions that can feel surprisingly lifelike. This guide unpacks how these toys listen, learn, and respond – and what that means for privacy, security, and healthy development. From data collection to the subtle influence of artificial voices, it highlights why adults may need to look more closely at the tech inside modern playthings.

It also explores how features such as constant connectivity, engagement-boosting rewards, and behaviour-shaping responses can affect children’s play habits. Alongside outlining the risks, the guide shares calm, practical advice to help parents and educators set boundaries, check permissions, and balance AI toys with offline experiences, ensuring AI remains a support for real-world interactions, not a substitute for them.

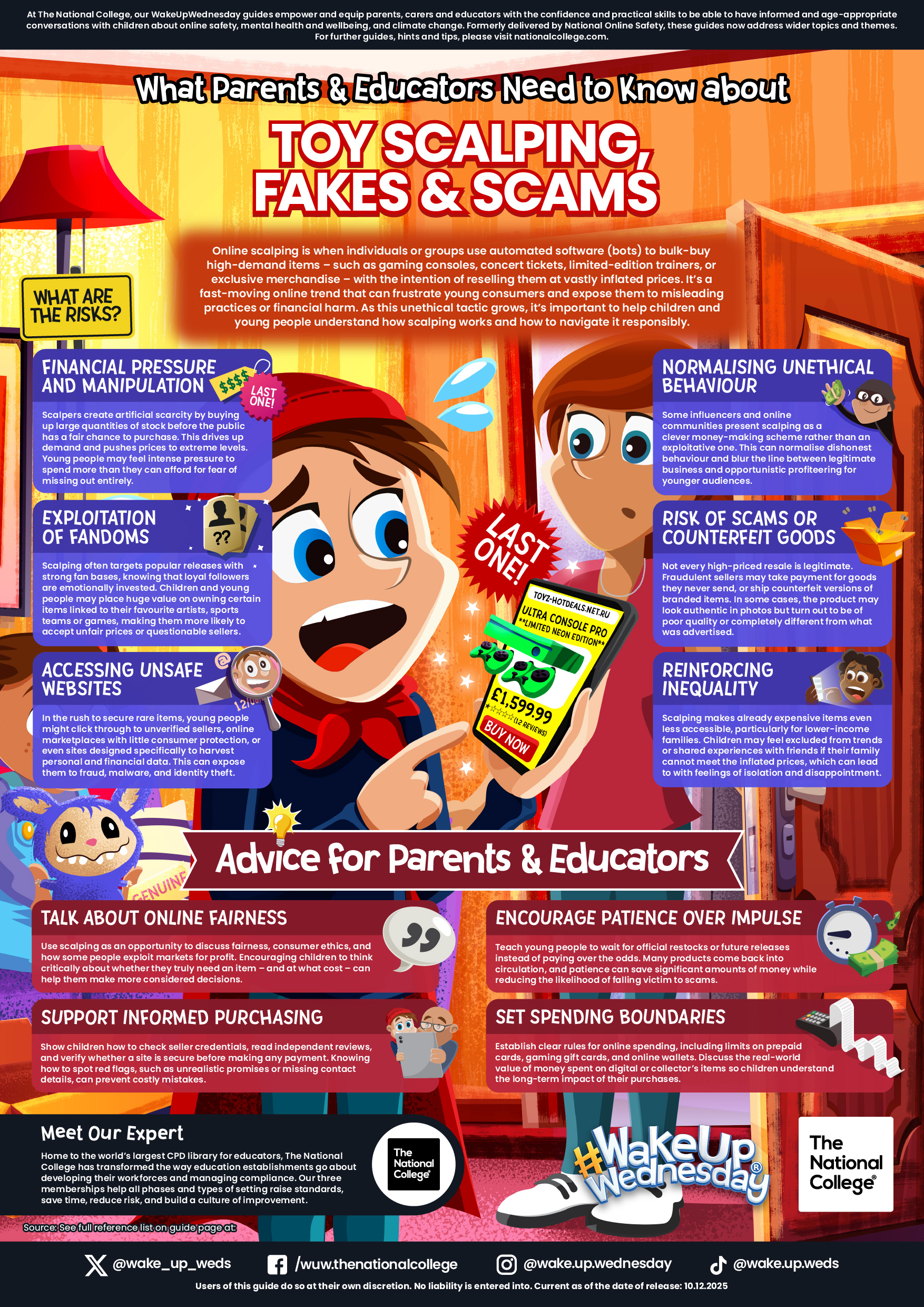

As this unethical practice becomes more visible, and, worryingly, sometimes glamourised online, it’s important to talk to children about fairness, financial boundaries, and spotting scams. This guide breaks down the tricks of the trade and how to avoid them, helping young consumers stay safe, informed and scam-free.